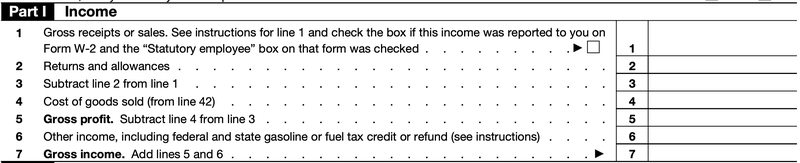

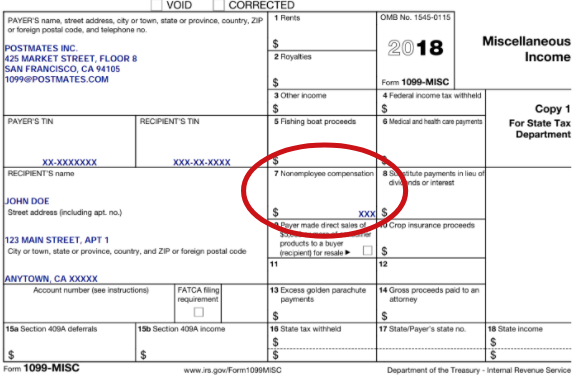

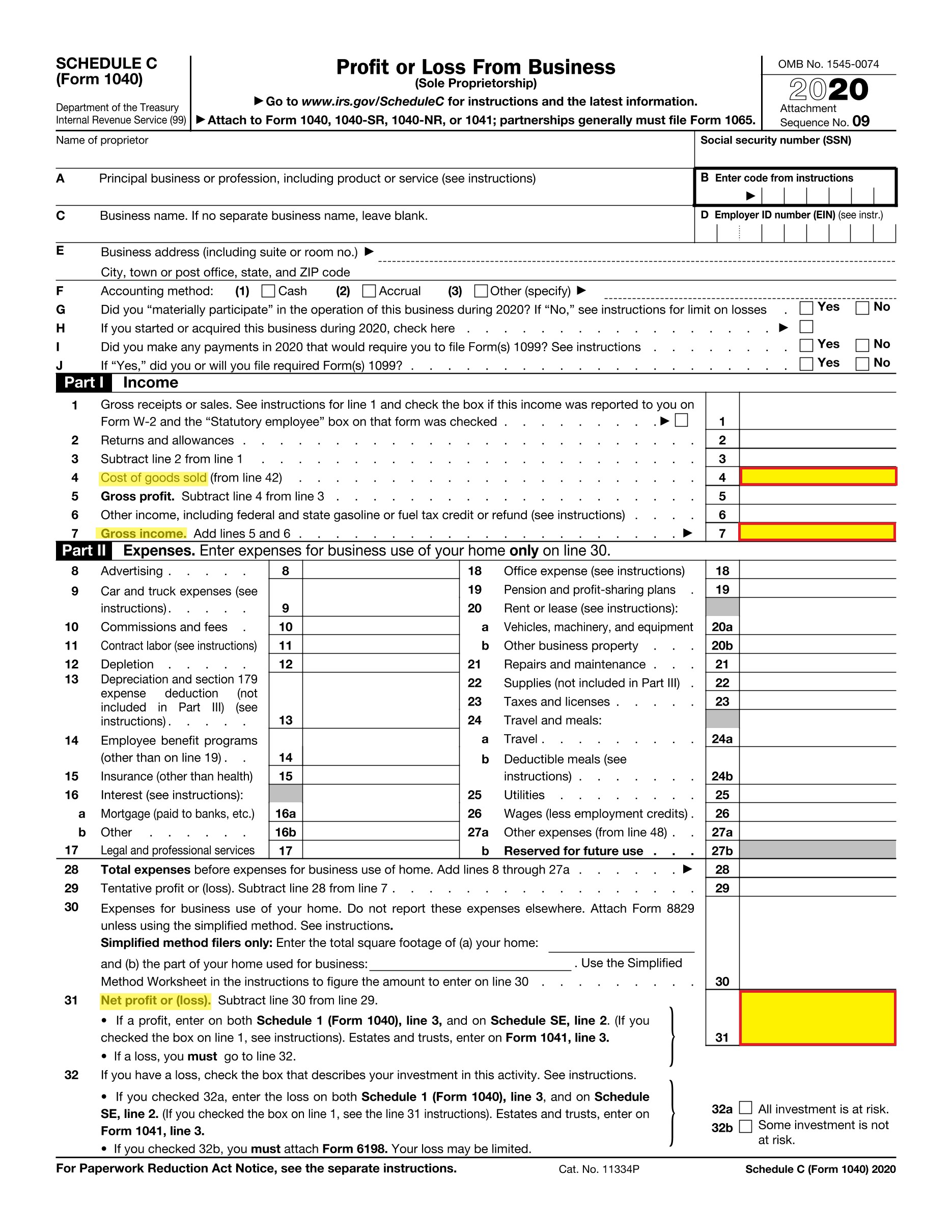

Entries on Form 1099G, Box 6 Taxable Grants (this covers certain government payments) are generally reported on IRS Schedule 1 (Form 1040), Line 8 If the item relates to an activity for which you are required to file Schedule C, E, or F or Form 45, report the taxable amount allocable to the activity on that schedule or form insteadFor individuals, report on Schedule C (Form 1040) Box 7 Shows nonemployee compensation If you are in the trade or business of catching fish, box 7 may show cash you received for the sale of fish If the amount in this box is SE income, report it on Schedule C or F (Form 1040), and complete Schedule SE (Form 1040)In this video, you will learn how to add a Schedule C, Profit or Loss From Business, to a 1040 return using MyTAXPrepOffice You will also learn how to add

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

1099 schedule c 2019

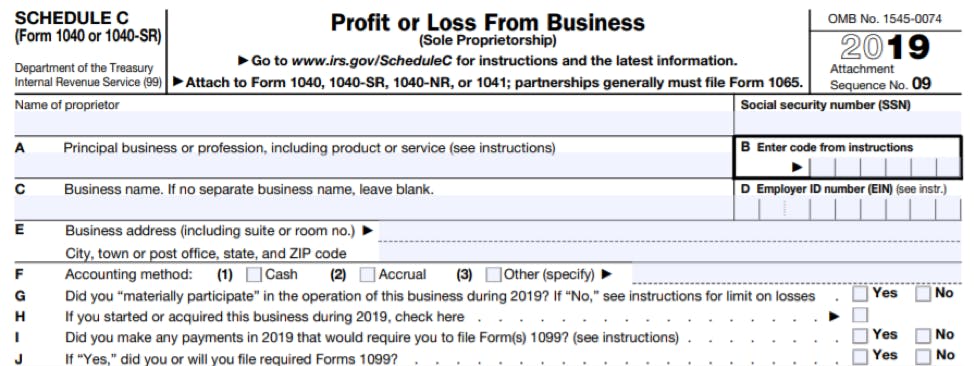

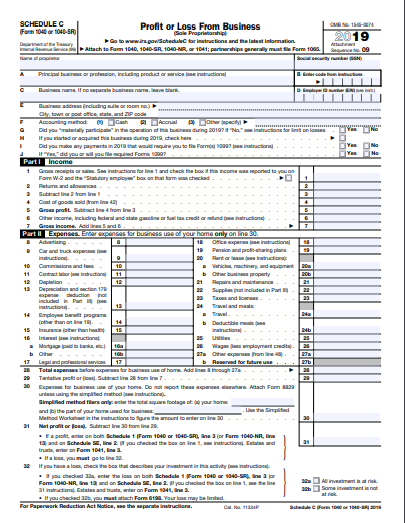

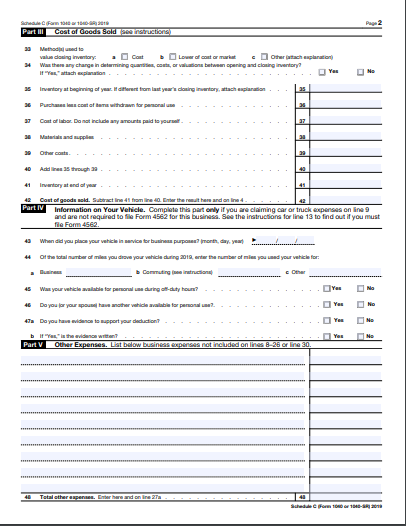

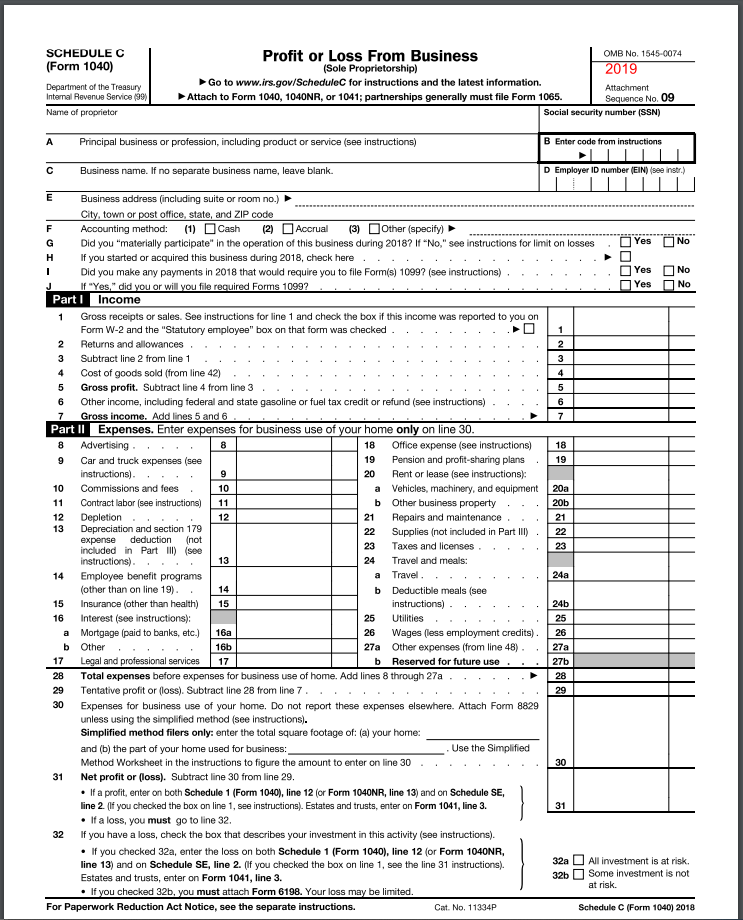

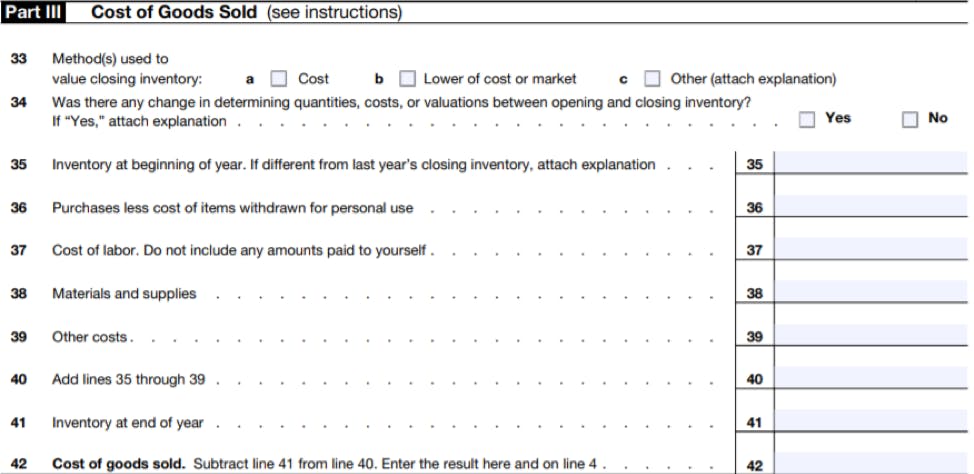

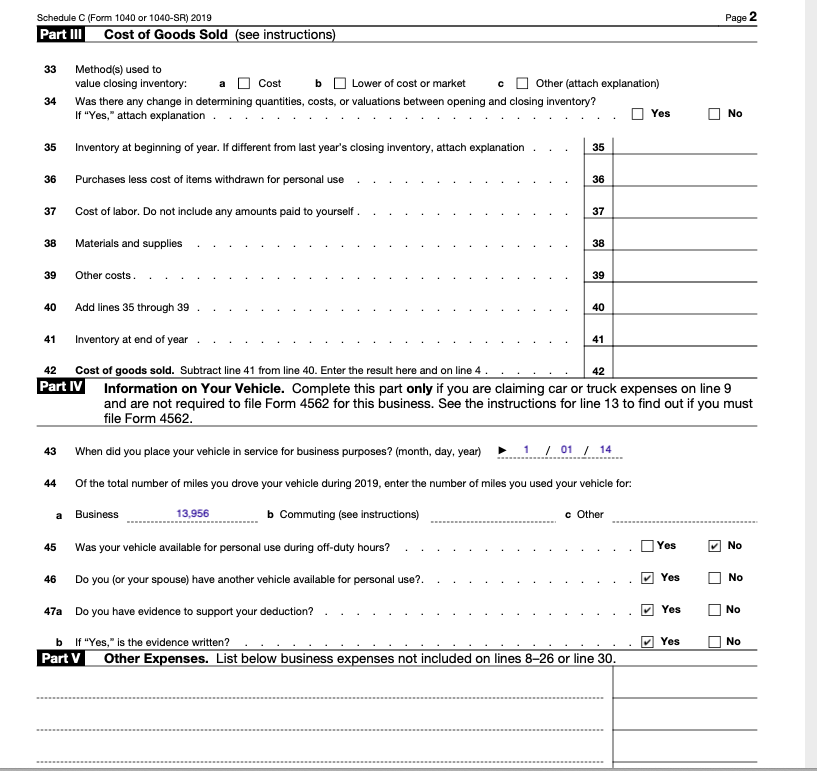

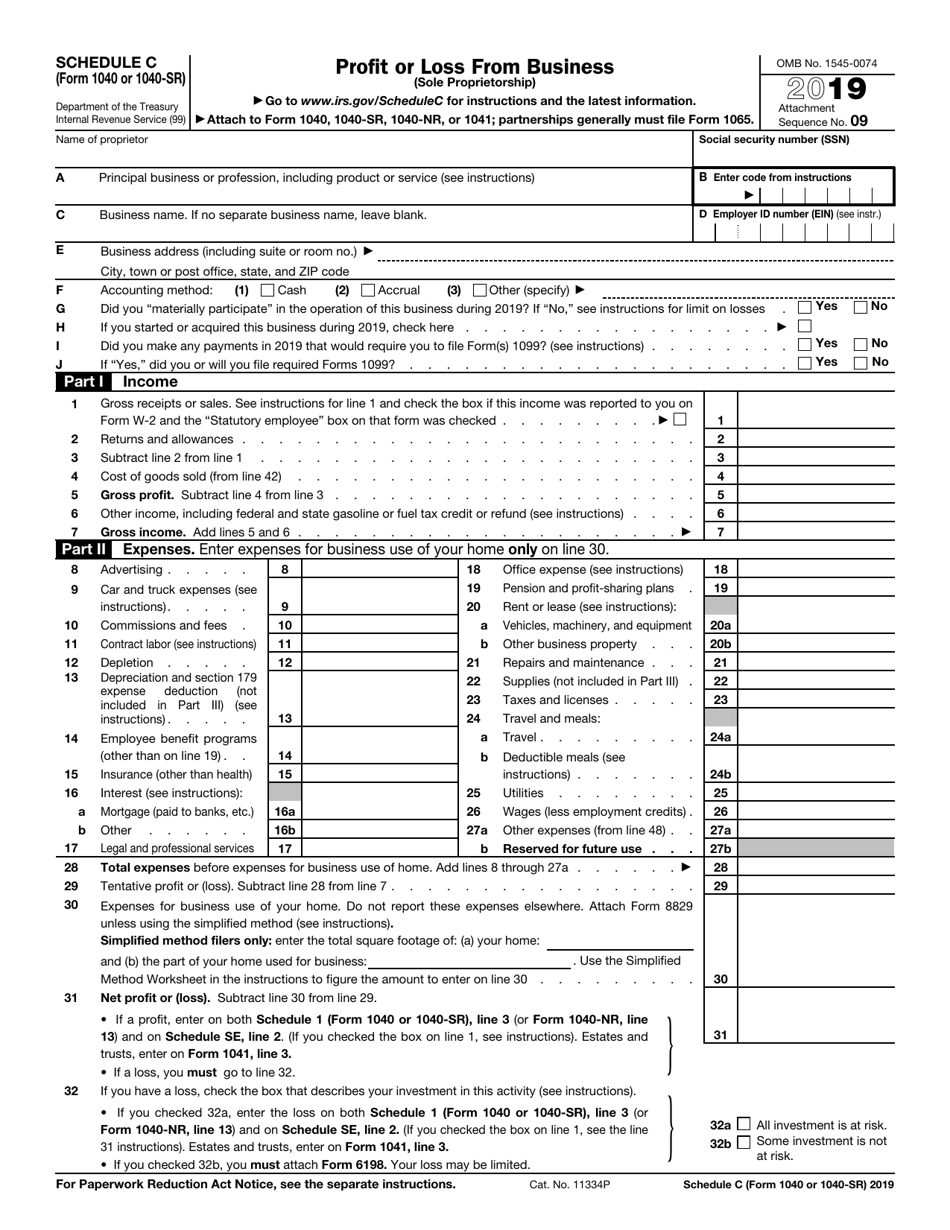

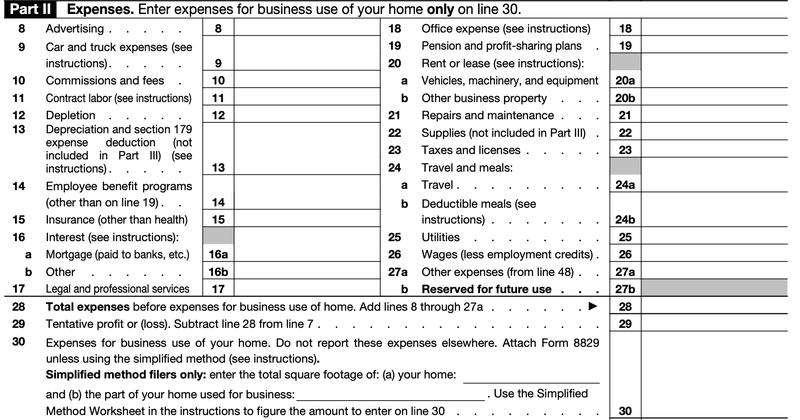

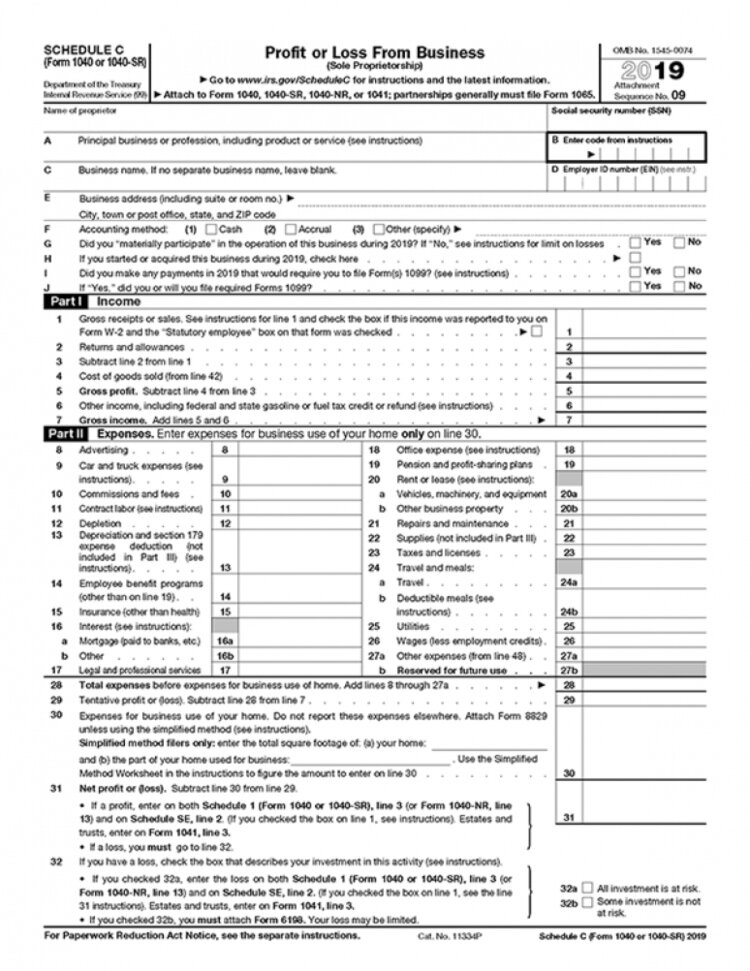

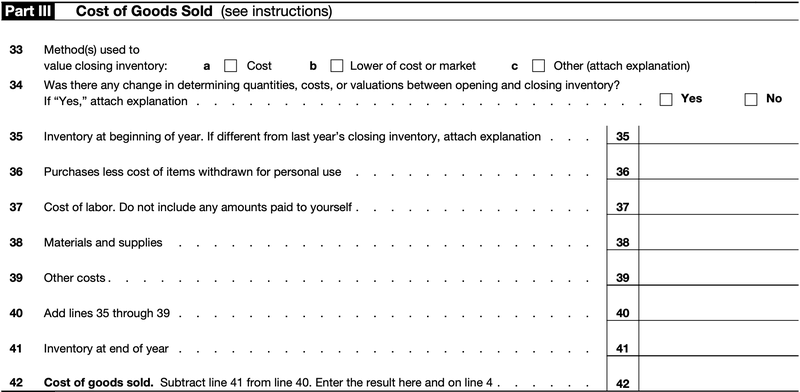

1099 schedule c 2019-C Business name If no separate business name, leave blank D Employer ID number Business address (including suite or room no) Author SEWCARMP Created Date Title 19 Schedule C (Form 1040 or 1040SR) Subject Profit or Loss From Business Keywords Fillable Last modified by(see instructions) Yes NoJ Schedule C (Form 1040 or 1040SR) 19 Schedule C (Form 1040 or 1040SR) 19 Page 2 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to

How To Fill Out The Schedule C

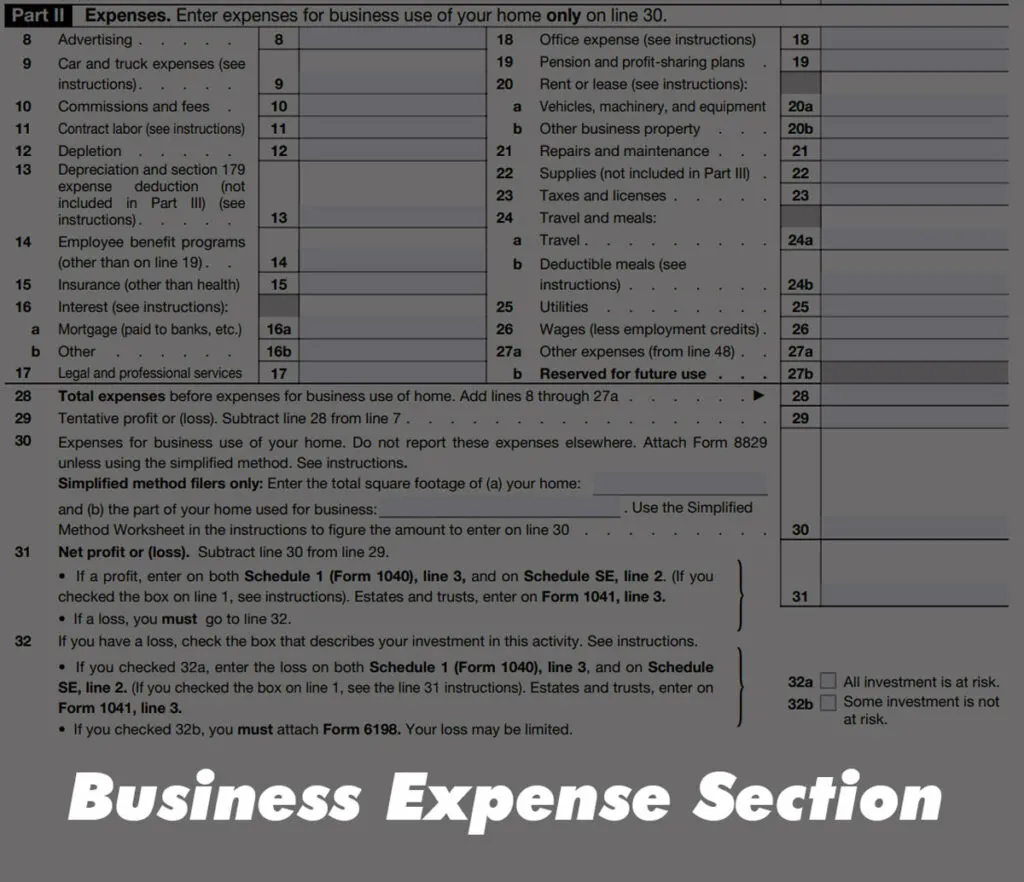

Jan 05, Independent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits orA color copy of your Driver's License (front and back) A voided check for your business bank accountAlso file Schedule SE (Form 1040), SelfEmployment Tax if net earnings from selfemployment are $400 or more This form allows you to figure social security and Medicare tax due on your net selfemployment income

However, if you are classified as an 'Independent Contractor' (wages are generally reported on a 1099Misc in Box 7 prior to tax year 19, and 1099NEC in box 1 starting with tax year ), you can still claim business expenses on your tax return You must complete a Schedule C to report your income and expensesForm 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099CAPMay 05, 21If you need Schedule C to report a 1099NEC or 1099MISC, search for 1099NEC or 1099misc and select the Jump to link We'll ask questions to find out if your 1099 income needs to go on Schedule C If your 18 or earlier return requires Schedule CEZ, we'll also generate a Schedule C for background calculation purposes only

19 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099A and 1099C Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 Form 1099BA Schedule CEZ is just a simplified ("easy") version You can use the CEZ only if you meet certain requirements The major requirements are that you only run one type of business and don't have more than $5,000 in business expenses You must include a Schedule C or CEZ with your Form 1040 during yearend taxesJan 15, 21What Documents Do 1099 Employees Need to Apply for a PPP Loan?

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Schedule C 19 Fill out, securely sign, print or email your 19 Instructions for Schedule C 19 Instructions for Schedule C, Profit or Loss From Business instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Nov 22, 19How Do I Use the 1099MISC Form I Receive?Click Create a New Schedule C to carry the income from Form 1099Misc If you already have a Schedule C, click the three dots to the right of the Schedule C to carry the income to the existing Schedule C The program will calculate the applicable selfemployment tax you will be subject to, based on the information provided in your Schedule C

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

1099 Misc Form Fillable Printable Download Free Instructions

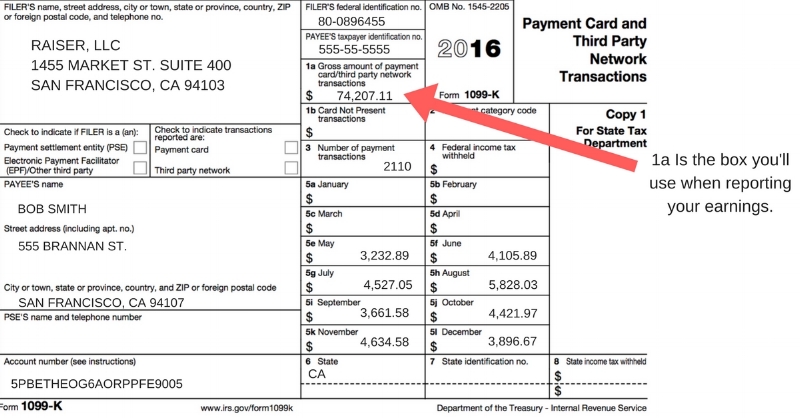

Jun 25, 19 Form 1040 Schedule C 19 Form 1099MISC (if available) 19 Invoices, Bank Statements, books, and records showing selfemployment status if form 1099 was not used invoices, bank statements, book, and records through 2/15/ to prove your business was still operating inApr 29, 21As such, the income for soleproprietors is reported on their Schedule C as gross receipts subject to the selfemployment tax Partnerships and corporations would report those amounts in a similar manner on their returns IRS enforcement of the 1099K form reporting When it first debuted in 11, Form 1099K was treated as almost a second thoughtJan 04, 21Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship);

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

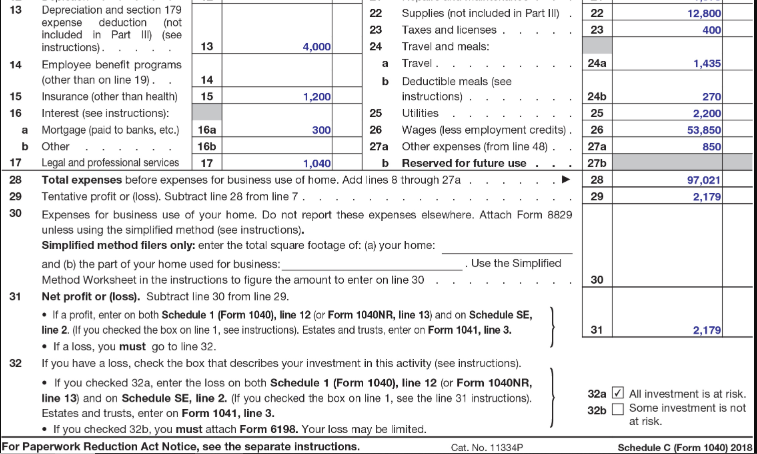

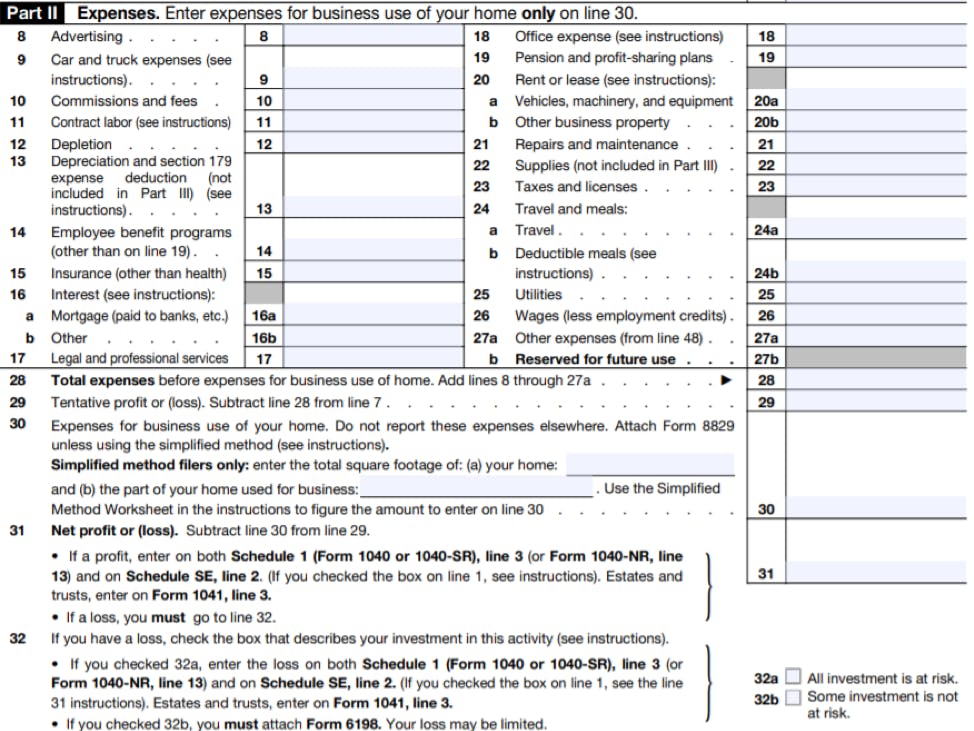

Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2 (If you checked the box on line 1, see instructions) Estates and trusts, enter on Form 1041, line 3 • If a loss, you must go to line 32} 31 32 If you have a loss, check the box that describes your investment in this activity See instructions • If you checked 32aFile 19 Tax Return File 18 Tax Return File 17 Tax Return File 16 Tax Return File 15 Tax Return File 14 Tax Return I have avoided doing my taxes because I am a self employed contractor with several 1099's and needing to do a schedule C This program is so easy it just walked me through it step by stepUsing Schedule CEZ instead (for tax years prior to 19) Many sole proprietors are able to use a simpler version called Schedule CEZ This form omits a lot of the detail in the full Schedule C and just asks for your total business receipts and expenses However, you still need to complete a separate section if you claim expenses for a vehicle

How To Claim The Home Office Deduction With Form Ask Gusto

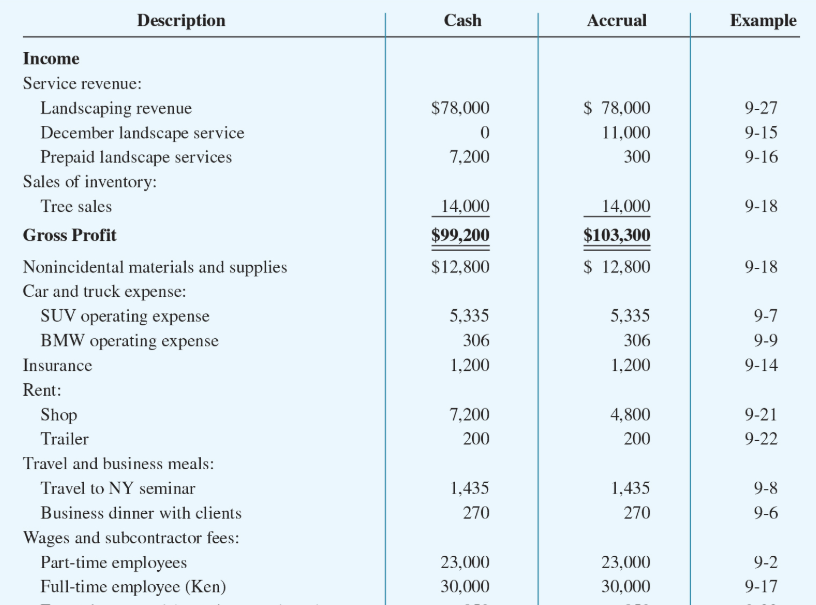

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

19 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 18 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 17 Inst 1099A and 1099CRegarding 1099A reporting, Form 1099A reports the sale of your home in foreclosure To figure the gain or loss See 1099A, Box 5 to figure the sales price — also called the amount realized If the box is marked "Yes," you have a recourse loan If19 Schedule C, which is now required If you haven't yet filed a Schedule C, you must complete one and submit it with your 1099MISC;

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

Irs Schedule C What It Is And When To Use It Rethority Real Estate Guides News And More

Jan 04, 14Schedule C or 1099 A 1099 is a form you use to report nonwage payments to others, or what others use to report their nonwage payments to you A schedule C is a form you use to report you business activity to the IRS with your tax return The two forms have completely different purposes, so asking whether to use one or the other makes no sense19 Schedule C Form Fill out, securely sign, print or email your 19 Instructions for Forms 1099A and 1099C IRSgov instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Jan 25, 21Including 1099 Income on Your Tax Return How you report 1099MISC income on your income tax return depends on the type of business you own If you are a sole proprietor or singlemember LLC owner, you report 1099 income on Schedule C—Profit or Loss From BusinessWhen you complete Schedule C, you report all business income and expenses

What Is Form 1099 Nec For Nonemployee Compensation

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Form 4852, Substitute for Form W2 or Form 1099R Form 4868, Automatic Extension of Time To File US Income Tax Return Form 4952, Investment Interest Expense Deduction1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting 1/25/21 Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC incomeYou can Create a new Schedule C or add the income to an existing Schedule C (same type of work) The income from the 1099Misc Box 7 or 1099NEC will be automatically pulled to the Schedule C If you have already added the 1099MISC/1099NEC in the program you will need to take different steps to associate the Schedule C to the 1099MISC/1099NEC

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Small Business Owners Need To Know About Stimulus Loans

ProWeb Form 1099Misc and Schedule C Form 1099Misc is used to report any miscellaneous income to a taxpayer that would not be included on a Form W2 This income can be for services, rents, royalties, prizes, etcSimilar to the W2, you'll enter the information provided on the 1099MISC on your tax return If you're a sole proprietor or a singlemember limited liability company (LLC), you report 1099MISC income on Schedule C Profit or Loss from a BusinessIt is the form on which you'll also report expenses related to your business1099C 19 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if

How To Fill Out Schedule C For Business Taxes Youtube

How To Fill Out The Schedule C

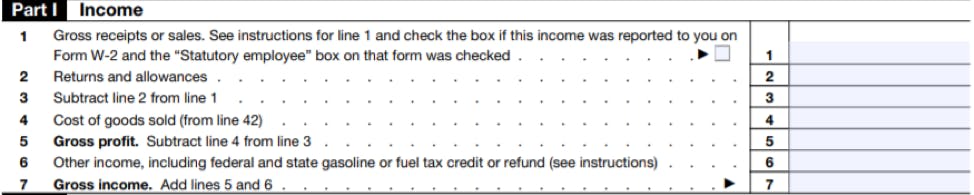

Jan 05, 19You may not file a Schedule C form jointly Reporting Profit or Loss on a Schedule C Part I of the Schedule C is used to calculate and report gross income from the business This is a necessary calculation for all businesses filing a Schedule C form, and other types of tax forms as well All businesses, regardless of their size, are requiredApr 24, We use Schedule C to report the income or loss in your business to the IRS Profit and Loss is the perfect report for us to get this data Simply go to the Reports tab, then search and select Profit and Loss In addition, we need to make sureJan 25, 21So basically if your 1099 forms, receipts 1040 Schedule C, etc for your tax return show a 25% revenue decline compared to 19, this is good enough to qualify for a second draw PPP loan For more details check out our FAQ guide How

1099 Misc For Uaw Strike Pay

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

Information about Schedule C (Form 1040 or 1040SR), Profit or Loss from Business (Sole Proprietorship), including recent updates, related forms, and instructions on how to file Schedule C (Form 1040 or 1040SR) is used to report income or loss from a business operated or a profession practiced as a sole proprietorDid you make any payments in 19 that would require you to file Form(s) 1099?If you believe you should have received a 1099K and have not received one by that date, consider contacting the processor to find out if it has prepared one for you If the processor did not prepare a 1099K, you should report your sales on Schedule C of the 1040 return and leave the 1099

18 21 Form Irs 1040 Schedule C Ez Fill Online Printable Fillable Blank Pdffiller

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

May 25, 19You can enter the income reported on your Form 1099K (along with any cash or checks you received) as selfemployment income on Schedule C Open or continue your return Search for Schedule C and select the Jump to link in the search results Next If you're entering info about your business for tInst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 21 Inst 1099BJan 31, 21Any income reported on Form 1099NEC is not reportable directly on your tax return Since this type of income is considered selfemployment (nonemployee compensation) it must be linked to a Schedule C, even if there are no expenses being claimed To add a Schedule C so your 1099NEC can be linked Open or continue your return in TurboTax

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To File Schedule C Form 1040 Bench Accounting

What Is A Schedule C Tax Form H R Block

Understanding Your Instacart 1099

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

What Are The Required Documents For A Ppp Loan Faq Womply

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc Ppp Loan Forgiveness Schedule C Youtube

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Schedule C Schedule C Form 1040 Profit Or Loss From Business Omb No 1545 0074 13 Sole Proprietorship For Information On Schedule C And Its Course Hero

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

What Is Tax Form 1040 Schedule Se The Dough Roller

:max_bytes(150000):strip_icc()/Form1040-651873f7a52b48edad115da1b595ad00.jpg)

Other Income On Form 1040 What Is It

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

1099 Misc Form Fillable Printable Download Free Instructions

Ppp Update 5 New Guidance For Individuals And Partners With Self Employment Income

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Step By Step Instructions To Fill Out Schedule C For

Given The Following Information Complete The 19 Chegg Com

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

The Ultimate Guide To Irs Schedule E For Real Estate Investors

Solved Schedule C Profit Or Loss From Business Omb No 1545 0074 Form 1040 Or 1040 Sr Sole Proprietorship 19 Go To Www Gov Schedulec For Inst Course Hero

Publication 559 Survivors Executors And Administrators Internal Revenue Service

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Schedule C Instructions With Faqs

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

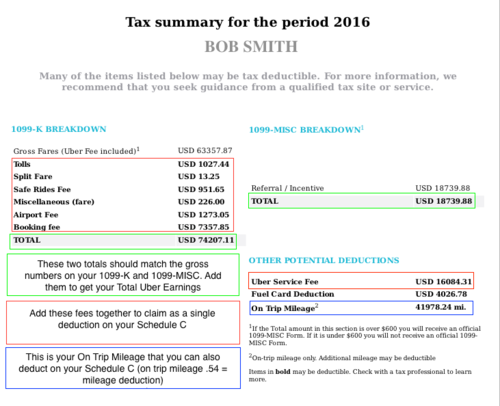

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Edit This Is The Complete Instruction I Just N Chegg Com

What Is Irs Schedule C Business Profit Loss Nerdwallet

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

:max_bytes(150000):strip_icc()/ScheduleC-22b719c014fd419b89315bb420243dcf.jpg)

Irs Schedule C What Is It

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Major Changes To Ppp Expands Eligibility For Self Employed Anash Org

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Postmates 1099 Taxes And Write Offs Stride Blog

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Form 1099 Nec For Nonemployee Compensation H R Block

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

Understanding Your Doordash 1099

Ppp Faqs 1040 Schedule C Tips For Independent Contractors Sole Proprietors And Self Employed

Freelancers Meet The New Form 1099 Nec

Schedule C Do Taxes

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Step By Step Instructions To Fill Out Schedule C For

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

Ultimate Tax Guide For Uber Lyft Drivers Updated For 21

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

Uber Tax Filing Information Alvia

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

Ppp Eligibility Calculator For Self Employed 1099 Homeunemployed Com

Irs Schedule C 1040 Form Pdffiller

How To File 19 Schedule C Tax Form 1040 Tax Form

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

What Is An Irs Schedule C Form And What You Need To Know About It

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

19 Schedule C Form 1040 Or 1040 Sr Ch 10

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 19 Templateroller

What Small Business Owners Need To Know About Stimulus Loans

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

What Are The Required Documents For A Ppp Loan Faq Womply

What Is Irs Schedule C Business Profit Loss Nerdwallet

0 件のコメント:

コメントを投稿